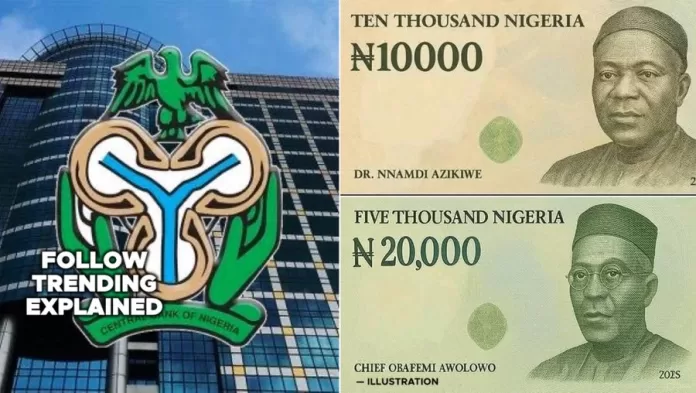

A new economic review by policy think-tank Quartus Economics has called on the Central Bank of Nigeria (CBN) to introduce higher-denomination naira notes, including N10,000 and N20,000 bills, to restore the currency’s portability and ease the rising cost and inconvenience of cash transactions in the country.

In its 2025 macro-economic commentary released on Thursday, Quartus Economics noted that inflationary pressures and steady depreciation of the naira have sharply eroded the value of existing denominations, making routine transactions particularly in cash-reliant informal sectors cumbersome and expensive.

“The naira’s purchasing power has diminished to the point where moving large sums now requires bulky cash, higher transaction fees, and increased security risks,” the report stated. “High-value notes will help restore portability, reduce logistical strain on banks, and cut cash-handling costs for businesses and households.”

READ ALSO: Tax Committee Unveils Media Excellence Award

The group argued that while digital payment adoption in Nigeria has expanded, millions of Nigerians especially in rural communities and informal markets still rely heavily on cash. It warned that ignoring physical currency reforms could widen financial exclusion and deepen frustrations among small traders and citizens who already face rising bank charges and network disruptions.

Comparative Context

Quartus Economics pointed to examples from countries like India and Indonesia, which introduced higher-value notes during similar inflationary cycles to manage transaction efficiency and reduce pressure on banking systems.

Mixed Reactions Expected

The proposal is likely to generate debate, especially following the CBN’s contentious 2023 naira redesign and cash-withdrawal limits, which disrupted economic activities nationwide.

Economic analyst Tunde Ogunleye told reporters the recommendation “makes practical sense but must be managed carefully,” adding that “higher notes do not solve inflation they only make everyday transactions easier. Monetary discipline, not bigger currency, stabilizes value.”

Consumer voices also reflect cautious optimism. “Carrying N500,000 for business is now like carrying a bag of rice,” said Lagos-based trader Fatima Yusuf. “Higher notes will help, but government must also make the economy better.”

What Next for CBN?

While the CBN has not responded to the report, industry observers say the proposal will test the bank’s policy direction as it balances inflation control, currency management costs, and its push toward a cash-lite economy.

Quartus Economics emphasized that the move should complement not replace ongoing digital payment reforms, urging the apex bank to roll out public sensitization and anti-counterfeit safeguards if approved.

As Nigeria continues to confront currency volatility and high living costs, the debate over higher-denomination notes may soon return to the center of monetary policy conversation.